This article will guide you through accessing a number of financial management settings for your online store, including permitted payment types and tax rates.

Accessing Online Store Configuration

1. Log in to your Member365 Administrator Dashboard.

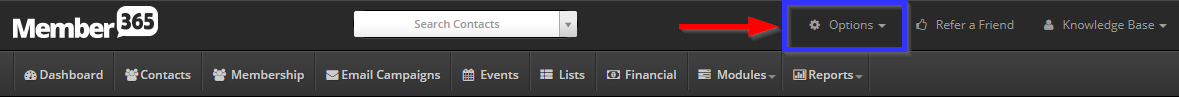

2. On the top bar, click ‘Options‘, and then click ‘Configuration‘ from the drop-down menu that appears.

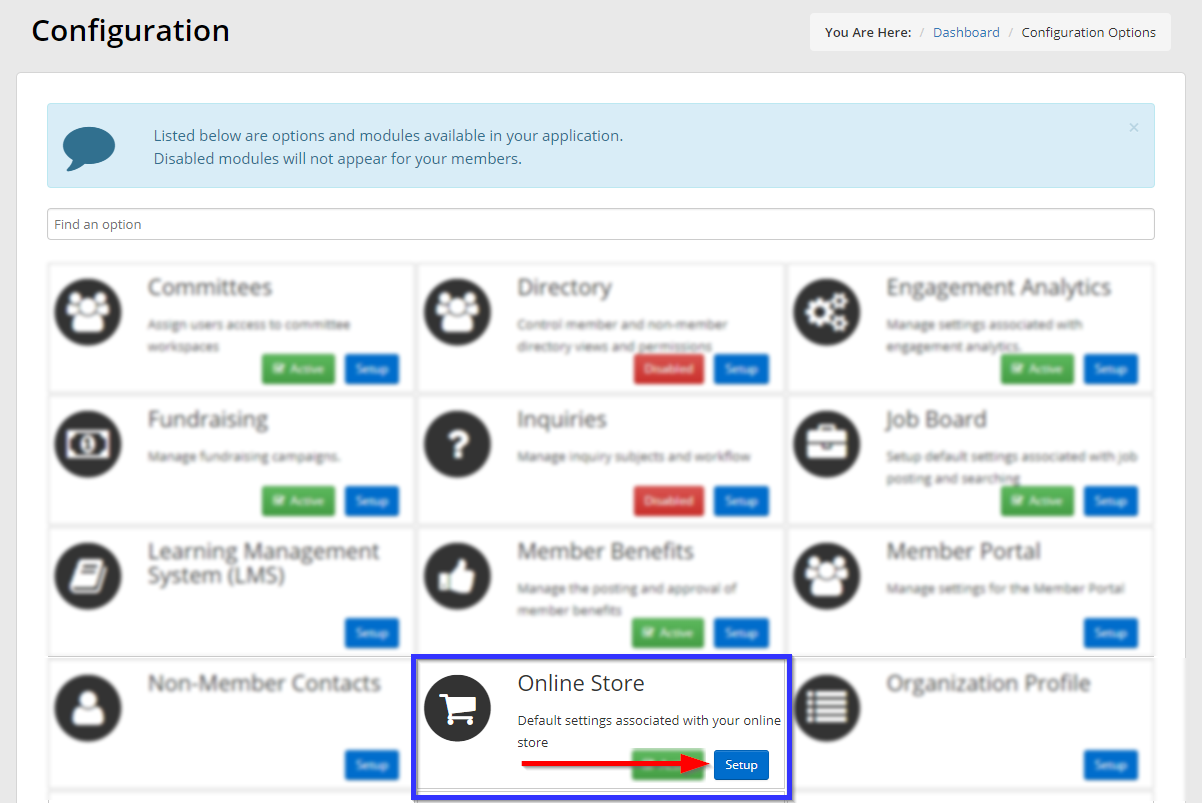

3. In the section marked ‘Online Store‘, click ‘Setup‘.

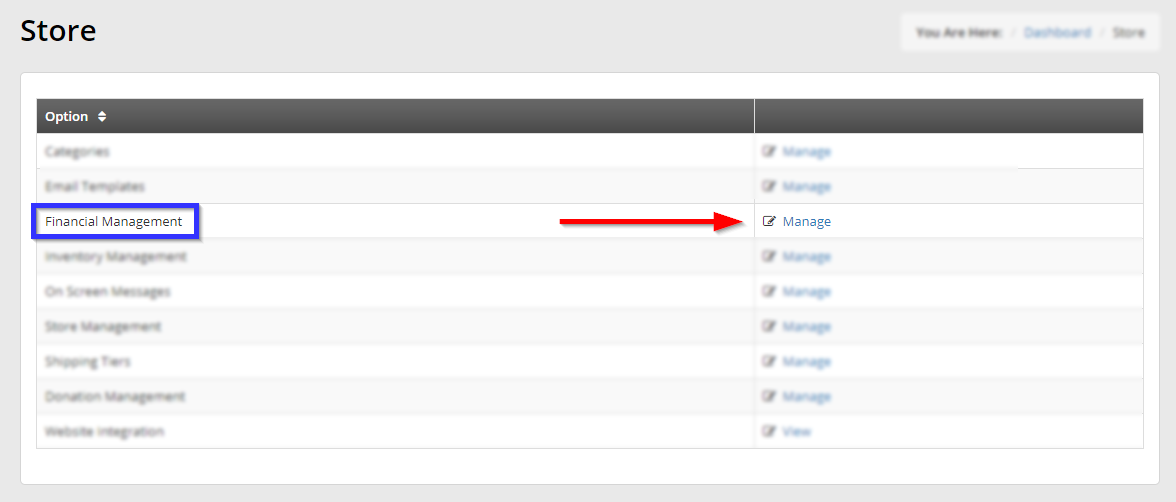

4. Next to ‘Financial Management’, click ‘Manage‘.

Financial Settings

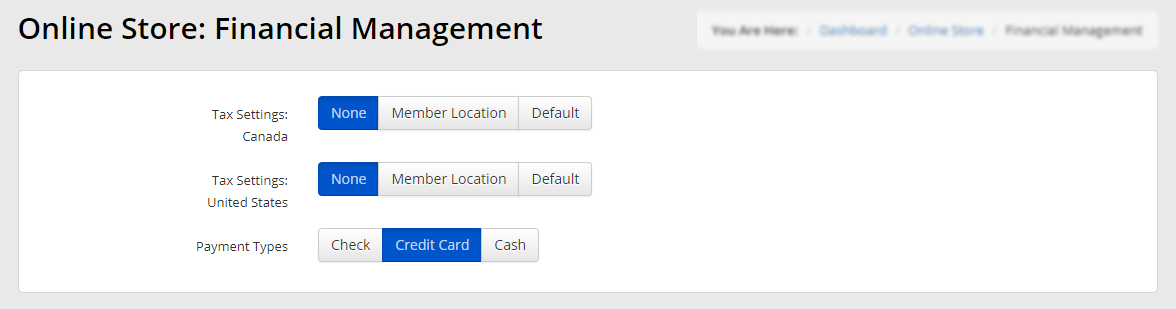

5. The financial management page offers a few settings for payments in your online store.

Tax Settings (Canada): Use these settings to apply either no tax, a tax rate specific to the location of the member making a purchase, or the rate you have set as the default Canadian tax rate. See this Knowledge Base article for details on setting your default tax rate.

Tax Settings (United States): Use these settings to apply either no tax, a tax rate specific to the location of the member making a purchase, or the rate you have set as the default American tax rate. See this Knowledge Base article for details on setting your default tax rate.

Payment Type: Select one or multiple of these payment methods to enable it for use in your store.

Congratulations, you have accessed your store’s financial settings!